Alliance releases 2025 Insurance Survey Findings:

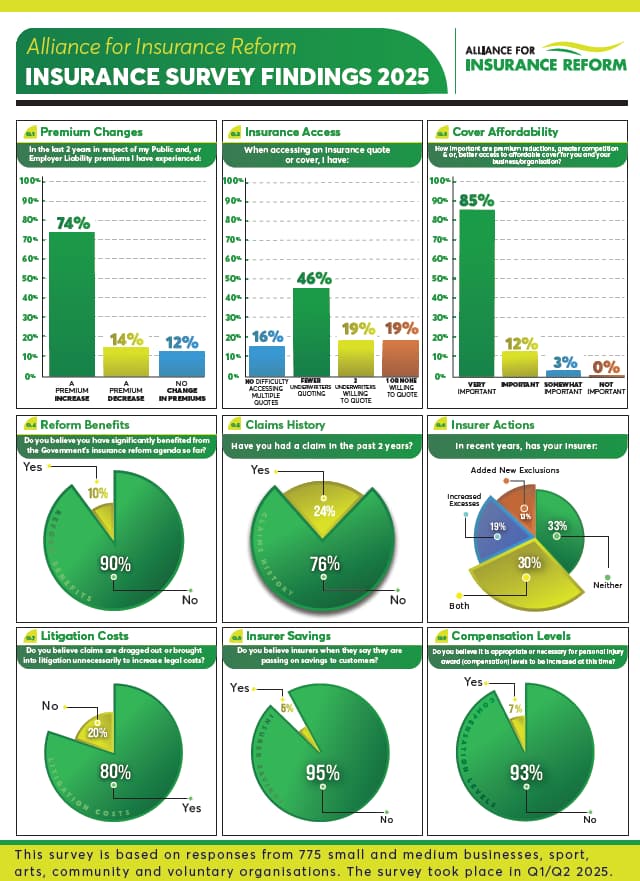

Today the Alliance for Insurance Reform publishes the findings of a significant survey it undertook with small and medium businesses, sports, community and voluntary groups in respect of their liability insurance cover in recent months. It received a very substantial 775 responses, and the findings are striking:

Speaking about today’s survey results grocery store owner and Alliance board member, Flora Crowe said: ‘the Government risks being seen as ‘completely out of touch’, if it approves an increase in awards that will see insurance premiums skyrocket – do they not know people just can’t afford it’.

‘It is only a few years ago that the Personal Injuries Commission found that awards here were 440% higher here than in England. The Personal Injury Guidelines brought them down a bit, but premiums have continued to go up. If they increase awards now, the Minister for Justice is guaranteeing that my premium goes up considerably. Motor insurance costs are certain to keep going up as well; I just don’t see how Ministers and TDs can support it.’

‘I run a small business like many other people, and the cost of business is already the biggest concern facing us and now the government looks set to make it worse. Where is the SME test in all of this? The increase will undo so much of the good work done on insurance reform by the last government. The findings in this survey couldn’t be clearer – I hope common sense will prevail, but I am very worried.’

[2] NCID Liability Report 2023 published March 2025 This data pertains to claims under €150,000 which reflects 94% of public liability claims.

We do our best to keep our information up to date. If you find any information that is out of date and has changed, please email us.

Copyright 2025 Sligo PPN | Website by Blossom Designs